Tactful Money Conversations

If you want your life to revolve around money, it’s easy. Get a side hustle, do extreme couponing, day trade, any of these activities could swamp your free time. It doesn’t have to be an activity either. Many things we want cost money, so it comes up constantly in ordinary life. If it becomes a source of anxiety, it can consume your life.

On our own, it becomes part of our regular routine. We see it as just the way we are.

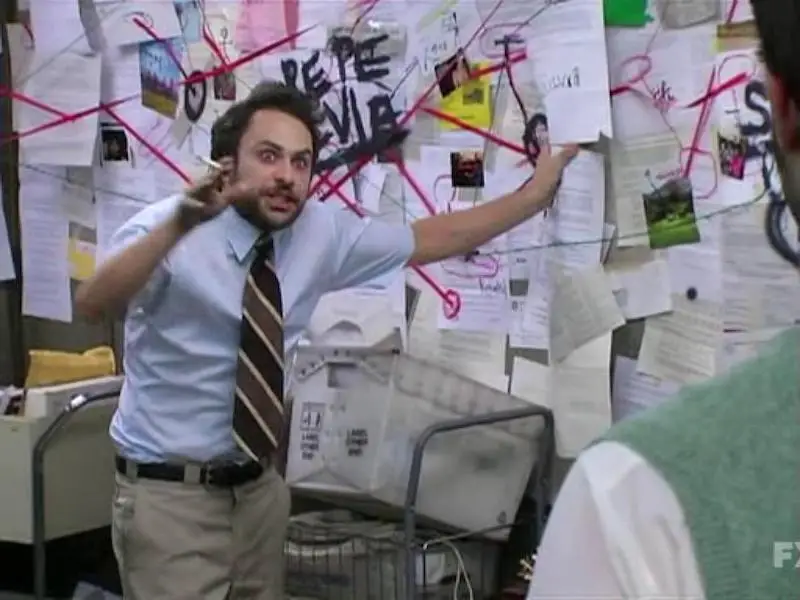

But once you introduce a partner into the mix, it can be a source of pain and conflict. Many people don’t find personal finance particularly interesting (or at least your brand of personal finance), so if you braindump on them, it can make you look like this guy:

In this post, we’ll talk about how to not piss off your partner when making decisions about personal finance. It’s for people who think deeply about money on their own but want to bring their partner for the ride. If you fall on the other side of the spectrum and identify more with someone who avoids personal finance like the plague, the companion article on saving time might be for you.

Try-Hards

In an era where people get married or have children later in their lives, most people learn how to manage money on their own before they meet a long-term partner. Many people only do the basics, but some people roll up their sleeves and spend hours per month planning and tracking.

These people wade into the deep end for different reasons. It’s a necessity if you’re living paycheck to paycheck. It can be an anxiety outlet if you’ve always worried about money. Whatever the reason, this careful attention to every dollar often becomes a source of pride and a reflection of their values.

For these people, finding middle ground with a partner who doesn’t care as much about personal finance can be challenging. On one hand, it makes sense for the more knowledgeable partner to take control. After all, they’re much better at it, or they’re at least willing to spend time on it. On the other hand, money management is life management. Almost everything in our lives can boil down to a money decision, so giving up control on money is basically giving up control on your life.

So how do you solve this conundrum? How do you find middle ground when none seems to exist? The story starts with finding a partner.

Middle Ground

Back when money was a more taboo topic (think 50+ years ago), people often talked about money too late, leading to nasty discoveries of secret debts or bad investments when they got married. This was a common trope in old movies and TV shows.

Nowadays, people are more open about these conversations, and prenups have grown in popularity. Not surprisingly, common advice for finding a partner has swung hard in this direction as well. People often talk about money now as early as possible, and they see mismatched attitudes on money as an immediate deal-breaker.

This is certainly smart in cases when one person is extremely irresponsible with money. After all, it’s hard to build a life together with someone who’s committing obvious self-sabotage like accumulating credit card debt. However, filtering partners on money attitudes can go too far as well.

Healthy relationships require finding middle ground. By not compromising on your money management approach, you’re doing one of two things. Either you’re trying to find a unicorn that believes and wants all the same things as you (never going to happen) or you’re grabbing power so that you don’t have to make any sacrifices for your partner.

The second one can sound extreme since usually it’s done with the best intentions (emphasis on usually), but again, remember that money decisions are life decisions. If your partner has to follow how you make money decisions, you’re the one really making all the life decisions. That’s not a recipe for a healthy relationship. It’s also a great way to piss off your partner, if not now then very shortly in the future.

The path forward requires acknowledging the need for compromise. Personal finance is about getting what you want with money, so doing personal finance with a partner means deciding what you want together. Not all couples are destined to work this out, but your chances are certainly higher if you allow for compromise.

After finding a partner who’s willing to work with you, the next step is to have the right mindset.

Manage Expectations (Your Own)

Personal finance can be boring. Spreadsheets, numbers, and financial markets are not everyone’s idea of a good time. You may have found it fun or soldiered through anyway, but it’s unrealistic to expect the same level of commitment from your partner. Even if your partner is a saint and is willing to try things your way, things can quickly fall apart when life gets busy.

Personal finance is about consistency, not one-time effort. It’s something you’ll be doing for the rest of your life. For dual income households, both partners have to do their fair share, especially if they can’t see each other’s accounts. One partner can temporarily pull the full weight of staying organized, but it tends to weigh on the relationship if it goes on for too long.

The more practical approach is to build a system together that works for both people. Usually, it’s something simpler than what you would do yourself. You may track spending less frequently, use simpler rules for buying investments, or something else, but the broader point is to design a system based around both people, not just you.

Relinquishing control this way can feel uncomfortable. It can seem like you’re wasting money needlessly or missing out on great investments. However, it helps to remember that spending more time on a thing doesn’t necessarily equate to better results. For example, studies on people who actively trade stocks show that they tend to have worse returns than people who buy and forget.

Even if simplifying workflows costs you money, remember that peace of mind has value too. Spending money for it is smart personal finance, not a waste of money. Our feelings today are frequently undervalued, so if you read a bit too much of personal finance advice, it can take some time to break the habit.

Big Picture First

As you’re creating a system with your partner, it’s best not to get lost in the weeds. If you’re already deep in the weeds though, it can be hard to know what’s too much detail and what isn’t. Fortunately, personal finance can be summarized into a few outcomes that are relatively easy to track. Rather than tracking 50 things, you can track 5-10 things and still feel confident that you’re covering your bases.

I’ve already covered these metrics in the companion article. While I won’t go over the value of strategic personal finance again, the takeaway is that the most efficient way to spend your time is also the most effective way to communicate how things are going.

Starting with a big picture metric like savings rate lets you assess the overall health of your finances before diving into details. If the overall health is good, perhaps you don’t need to dive into the details at all, saving both you and your partner precious time and energy.

Final Thoughts

For the personal finance enthusiasts out there, you may know more about money than your partner, but it’s no moral high ground. Finding a way to compromise and collaborate on money will save you many pointless fights and make your relationship with your partner stronger.